Saint Kitts and Nevis—the federation in the Eastern Caribbean comprising two picturesque islands—offers a fascinating blend of colonial history, modern ambition, and emerging economic promise. With a population of just 48,000 and a combined GDP of around US$1.1 billion, this tiny nation punches above its weight thanks to a growing tourism industry, progressive digital reforms, and initiatives like its citizenship‑by‑investment program that draw global interest (Global Finance Magazine).

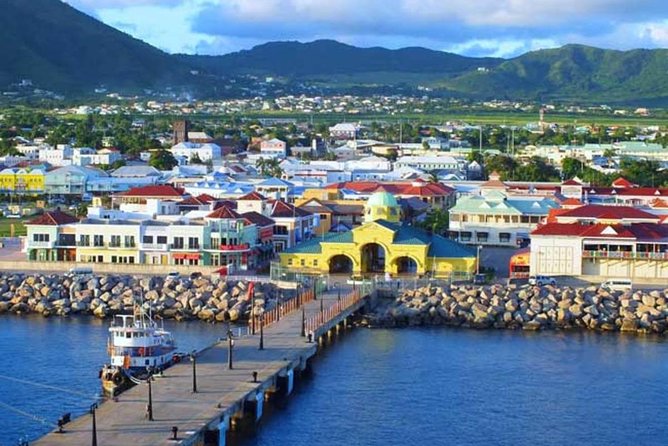

At the center of country life is Basseterre, the capital of Saint Kitts. With a population of about 17,000, it is not just an administrative hub but also a regional financial center, hosting the Eastern Caribbean Central Bank and the Eastern Caribbean Securities Exchange—the only public stock market in the region (Wikipedia). Basseterre’s port and airport serve as pivotal points for tourism, trade, and commerce, powering much of the nation’s growth.

Tourism remains the backbone of the economy, directly contributing 13–14% of GDP and—when accounting for indirect effects—nearly 45% of overall economic activity (IMF+15Assets Global+15Global Finance Magazine+15). In 2022, real GDP rebounded with single-digit growth, and while GDP growth slowed to about 1.5% in 2024, ongoing recovery and investment support from citizenship schemes and infrastructure projects are expected to fuel steady medium-term expansion (IMF eLibrary, IMF eLibrary, State Department).

Amid crosswinds of global conditions, Saint Kitts and Nevis has welcomed foreign capital—particularly through its citizenship‑by‑investment program, which generated substantial inflows and underwrote fiscal resilience in the post‑pandemic period (macrotrends.net+12caribank.org+12State Department+12). Although formal FDI—excluding citizenship capital—fell to around US$31 million in 2023, it reflected more cyclical dynamics than structural decline (macrotrends.net).

A growing focus on digital entrepreneurship and financial literacy is reshaping local attitudes. Educational institutions and government agencies are encouraging small business growth, digital finance tools, and e‑commerce among the younger generation. While retail trading and forex activity remain nascent, there is increasing awareness of global investment, supported by improved financial infrastructure and English-language education.

In Basseterre and Nevis towns like Charlestown, residents are exploring digital investing, trading platforms, and online business ventures. With nearly universal literacy (~98%) and widespread mobile connectivity, the islands are gradually positioning themselves as more than just a tropical destination—they’re becoming a micro‑hub of international fintech and entrepreneurial ambition (Wikipedia, Wikipedia).

For traders in Saint Kitts and Nevis, HFM stands out as the top forex broker, offering a powerful blend of tight spreads, diverse trading assets, and exceptional client support. AvaTrade also ranks highly, providing regulated access to global markets and user-friendly platforms that suit both beginners and experienced investors.

HFM – Best Overall Broker

HFM (formerly HotForex) is the leading forex broker for traders in Saint Kitts and Nevis. With more than a decade of experience, HFM offers access to forex, commodities, indices, stocks, and cryptocurrencies on platforms like MetaTrader 4 and 5. Traders in Saint Kitts and Nevis value HFM’s tight spreads—often starting around 0.1 pips—multiple account types including Islamic (swap-free) accounts, and low minimum deposits, making it ideal for emerging retail traders. Its active customer support team and educational resources—available in multiple languages—make it accessible to those just starting out. HFM’s strong regulatory oversight from tier‑1 bodies such as CySEC and FCA gives regional users the confidence they need to trade globally with minimal risk.

AvaTrade – Strong Second Choice

AvaTrade, in operation since 2006, offers a highly polished trading experience popular with traders in Saint Kitts and Nevis who favor simplicity and reliability. With over 1,250 tradable assets—not only forex but also stocks, ETFs, commodities, options, and cryptocurrencies—it caters to users looking to diversify. AvaTrade’s spread options include both fixed and floating rates, and the platform supports MetaTrader, AvaTradeGO, and AvaOptions. Regional traders often highlight the broker’s educational tools and solid risk management features, such as AvaProtect and copy-trading integration. Multi-lingual, day-trading-oriented customer service supports smooth onboarding for new investors, and its reputation under multiple global regulators reinforces trust for international access.

AvaTrade – Also Third Choice Reflecting Consistent Quality

Interestingly, AvaTrade appears again as the third-ranked broker in Saint Kitts and Nevis—not due to a ranking error, but to underscore its reliability and consistency across different trading styles. The broker equals itself by offering both beginner-friendly ease of use and sophisticated tools suitable for advanced strategies. AvaTrade remains a go-to option for tech-savvy traders seeking niche strategies such as options or algorithmic trading, thanks to its proprietary platforms and serene regulatory environment. Its customer service, seamless withdrawal process, and continued innovation make it a strong, multi-faceted choice for local traders exploring global finance.

Traders’ Characteristics in Saint Kitts and Nevis

Traders in Saint Kitts and Nevis remain few in number but increasingly engaged, drawn largely from tourists, returning diaspora, and English-speaking locals with access to global financial platforms. The twin-island federation boasts a population of just over 51,000 people (Wikipedia), yet its capital Basseterre, hosts the regional Eastern Caribbean Securities Exchange, making the country a modest hub for financial activity (Wikipedia).

Though there are no formal local forex brokers due to the absence of a domestic regulator, many residents participate via internationally licensed providers, often choosing platforms aligned with Eastern Caribbean monetary policies and English-language support (FX List+4FX List+4FX Leaders+4).

The economy’s backbone remains tourism, contributing around 45% of total economic activity, with real GDP growing 8.8% in 2022 and forecasted 4.7% growth in 2024, buoyed by citizenship-by-investment inflows and targeted infrastructure upgrades (IMF eLibrary). Remittances—accounting for roughly 3.2% of GDP in 2020—provide supplemental capital that many households reinvest in small-scale ventures or global trading platforms (Wikipedia+5aspeninstitute.org+5ceintelligence.com+5).

Typical forex traders in Saint Kitts and Nevis start with modest sums—often USD 200 to 1,000—testing the waters using demo accounts before moving into live trading. Their focus tends to be on major currency pairs like EUR/USD, USD/EUR, or USD-related CFDs, aligning with the transactional needs of the tourism-driven local economy.

Although national financial inclusion initiatives are limited, access to English-language banking, a 98% literacy rate, and near-universal mobile connectivity enable growing interest in digital financial tools. Younger locals are especially drawn to copy trading, automated strategies, and basic forex education via online platforms.

- Best Forex Broker in Zambia for Ambitious Young Investors - August 4, 2025

- Best Forex Broker in Western Sahara – Growth Amid Simplicity - August 4, 2025

- Best Forex Broker in Wallis and Futuna – Low Capital, High Interest - August 4, 2025