Nestled in southern Africa between South Africa and Mozambique, Eswatini—formerly Swaziland—is a compact kingdom with a rich cultural heritage and growing economic momentum. With deep traditions rooted in monarchy and Swazi identity, the country today is undergoing a quiet transformation toward greater economic diversification, digital engagement, and entrepreneurial energy.

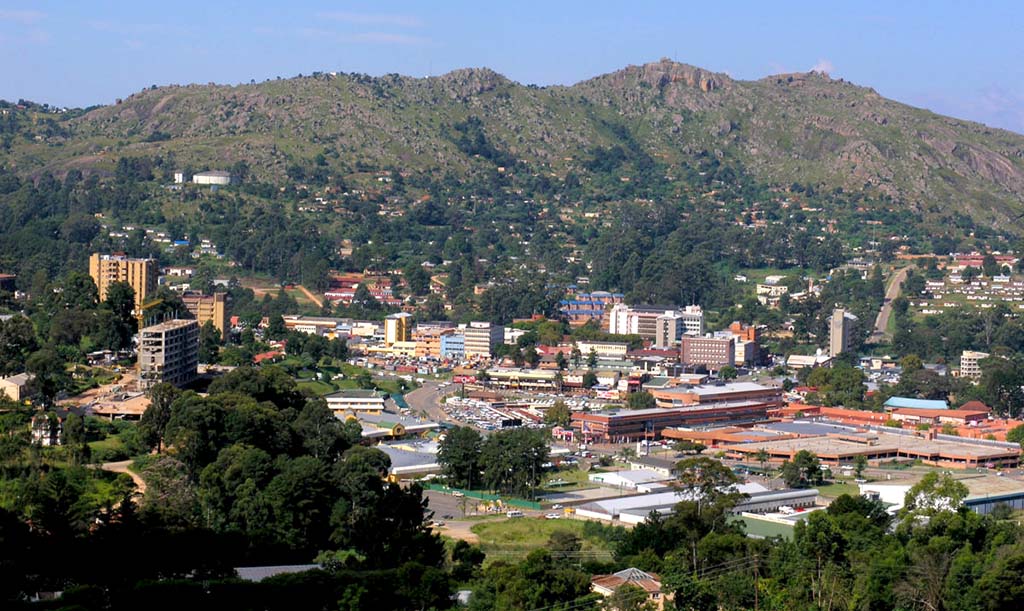

At the heart of national life is Mbabane, the executive capital. With modern administrative buildings and a growing business district, Mbabane anchors Eswatini’s political, commercial, and service sectors. As the focal point of governance and trade, it plays a central role in steering economic development across the country.

Eswatini’s economy rebounded in recent years—from just 0.5% real GDP growth in 2022 to an impressive 4.8–4.9% in 2023, supported by strong exports of sugar and soft drink concentrates, a resilient services sector, and expanding tourism revenues (Wikipedia+8African Development Bank+8Wikipedia+8, IMF eLibrary+1VCDA+1). Though still modest in scale—nominal GDP stands at just US$4.6 billion, with per capita output around $4,100 (World Bank, Wikipedia)—the economy’s rising services segment now makes up over 50% of GDP, with manufacturing contributing about 33%, particularly in textiles and agro-processing (Wikipedia, Trade.gov). Foreign direct investment remains tied to traditional sectors like sugar and apparel, yet efforts to improve the investment climate are underway, with structural reforms focused on business regulation, financial transparency, and digital infrastructure.

Among the most promising trends is the emergence of financial literacy and entrepreneurial drive, particularly among young, urban residents. Digital banking and fintech solutions are gradually expanding access, supported by growing mobile connectivity and nascent startup hubs in Mbabane and Manzini. While formal inclusion remains limited, fintech pilots and ecosystem planning—led by entities like the Alliance for Financial Inclusion—are beginning to pave the way (afi-global.org). As Swatis gain exposure to global financial instruments, interest in forex trading, e‑commerce, and small-scale digital ventures is rising, particularly among those with diaspora links or remittance income.

HFM is the leading forex broker in Eswatini, offering low spreads, high leverage, and excellent support tailored to traders in emerging markets. AvaTrade and Exness also rank highly, providing reliable platforms, diverse assets, and tools that make forex trading accessible for both beginners and experienced Swati investors.

HFM – Best Overall Forex Broker in Eswatini

HFM (formerly HotForex) has operated since 2010, debuting in emerging markets with flexible account options and strong platform support. It features spreads from 0.0 pips, high leverage (up to 1:2000), and access to over 500 tradable instruments, including forex, indices, commodities, stocks, and crypto. For users in Eswatini, where banking infrastructure remains limited, HFM’s low minimum deposit accounts, fast processing, and 24/5 multilingual support make getting started easier. Its compatibility with MT4, MT5, and copy-trading tools enables both beginners and veterans to trade confidently. With regulation under authorities like FCA and CySEC, Swati traders enjoy a secure, globally trusted platform—ideal for those seeking entry to global markets with minimal friction.

AvaTrade – Best for Education & Platform Diversity

AvaTrade, in business since 2006, is perfect for traders in Eswatini seeking structured learning and a variety of platforms. It’s offering of over 1,250 instruments—including forex, stocks, ETFs, options, and crypto—complements support for MT4, MT5, AvaTradeGO, and social trading through ZuluTrade and DupliTrade. While spreads begin around 0.9 pips, AvaTrade distinguishes itself through educational webinars, risk-management tools like AvaProtect, and well-regulated operations under ASIC and the Central Bank of Ireland. Traders with rising financial literacy in Eswatini appreciate its comprehensive resources and illustrative onboarding friendly to emerging-market audiences.

Exness – Best for Affordable Access & Fast Withdrawals

Exness, established in 2008, appeals to cost-conscious and liquidity-focused Swati traders. It offers ultra-low (and often zero) minimum deposit, competitive spreads, and instant withdrawals—critical for users relying on remittance-linked liquidity. The broker delivers access to forex, CFDs, indices, commodities, stocks, and crypto with support for automated trading and VPS hosting. Its straightforward fee structure and robust execution resonate with Eswatini clients prioritizing accessibility and operational efficiency, backed by regulation from top-tier authorities like FCA and CySEC.

Traders’ Characteristics in Eswatini

Traders in Eswatini are increasingly influenced by rising financial inclusion, mobile connectivity, and remittance-backed liquidity flows. Forex trading is legal and regulated under the Central Bank of Eswatini and the Financial Services Regulatory Authority (FSRA), which has fostered growing trust among new retail participants (FX Leaders). With GDP growth rebounding to 4.8% in 2024 and per capita income around $4,100, Swati investors are gradually allocating surplus funds into training-driven ventures like forex, especially in urban areas like Mbabane and Manzini (World Bank).

Despite structural challenges, emerging fintech pilots and payment innovations are expanding access to digital finance. While formal data on typical trading capital is scarce, anecdotal evidence suggests local traders often start with modest sums—USD 500–$2,000—to explore global markets via offshore brokers (UNDP+2Benzinga+2wealthwayfx.com+2). Meanwhile, the Eswatini Stock Exchange, though small, supports a growing interest in equities and CFD trading among literate urban users comfortable with e-trading tools (Wikipedia+15Wikipedia+15Day Trading+15).

Major investor trends include cautious adoption of forex and CFDs, particularly leveraging the Swazi Lilangeni (SZL) against major currencies like USD. Traders often rely on broker platforms offering copy-trading, low commissions, and mobile access. With financial inclusion strategies underway and rising literacy, Eswatini’s emerging trader base—driven by youth and diaspora—blends conservative capital habits with gradual openness to digital entrepreneurship and online markets (Benzinga+3FX Leaders+3Day Trading+3).

Conclusion

Eswatini may be small, but its traders are increasingly empowered by digital tools, remittance income, and regulatory support. Brokers like HFM, AvaTrade, and Exness offer accessible gateways into global forex markets, helping local users begin their investment journey with clarity and confidence. With rising financial inclusion and entrepreneurial spirit, Eswatini’s future holds promise for broader engagement in international trading and digital finance.

- Best Forex Broker in Malaysia – Where Smart Traders Invest - August 1, 2025

- Best Forex Broker in Malawi – Powered by Rising Literacy - August 1, 2025

- Best Forex Broker in Madagascar – Where Smart Traders Emerge - August 1, 2025