Nestled in the eastern Himalayas, Bhutan is a nation known as much for its breathtaking landscapes and serene monasteries as for its commitment to Gross National Happiness. With a deep-rooted cultural heritage that reveres sustainability and well-being, Bhutan has historically taken a cautious approach to modernization. Yet in recent years, the country has seen a significant shift toward economic reform and diversification — transforming from an isolated mountain kingdom into a small but promising player on the global economic stage.

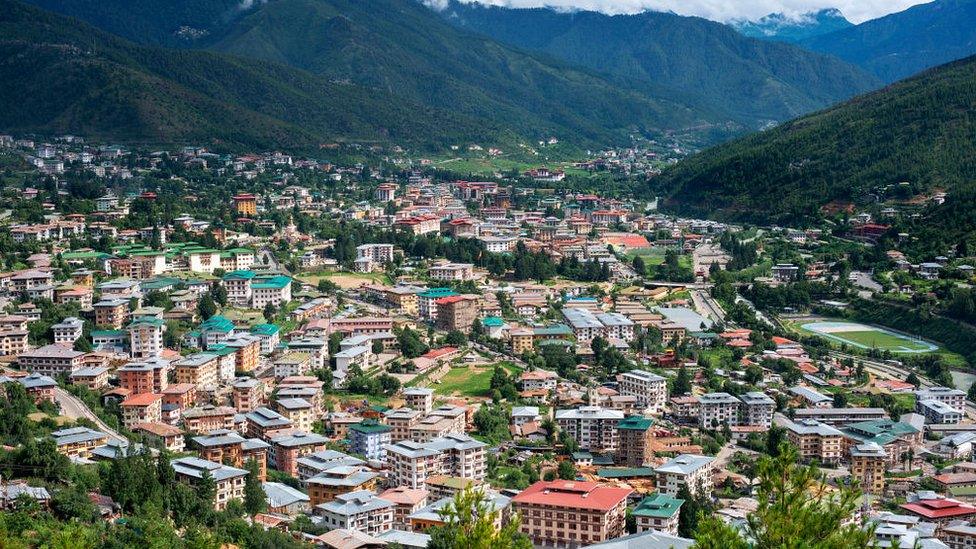

The capital city, Thimphu, is at the heart of this transformation. Once a quiet administrative center, Thimphu has blossomed into a hub of innovation and governance, balancing traditional Bhutanese architecture with modern infrastructure. The city’s growing influence in commerce, technology, and policy-making has helped pave the way for nationwide development initiatives. As a result, Bhutan is slowly but surely building a reputation for digital readiness and entrepreneurial ambition, especially among its younger population.

Economically, Bhutan has maintained impressive stability. The country’s GDP growth has hovered between 4% to 7% in recent years, supported by hydropower exports — particularly to India — which remain the backbone of Bhutan’s economy. The government has also implemented structural reforms aimed at strengthening fiscal policies and attracting foreign direct investment (FDI), particularly in the tourism, renewable energy, and tech sectors. In 2022, Bhutan recorded over $100 million in FDI, a notable figure considering the nation’s size and relatively nascent global integration.

Importantly, financial literacy in Bhutan is on the rise. Various government initiatives, non-profit programs, and digital platforms have encouraged Bhutanese citizens to engage with formal banking, savings, and investment opportunities. This growing awareness has led to increasing participation in online trading platforms and forex markets, especially among tech-savvy urban dwellers. Many young professionals and entrepreneurs in Bhutan are exploring forex trading as a means of building supplemental income and engaging with global financial markets — a major shift for a nation once reliant solely on traditional forms of commerce.

Furthermore, Bhutan’s digital infrastructure has improved significantly, enabling greater access to digital entrepreneurship. With mobile penetration above 90% and a growing internet user base, Bhutanese traders and small business owners are tapping into online tools to manage investments, launch ventures, and learn trading strategies.

HFM stands out as the best forex broker in Bhutan, offering a robust trading platform, tight spreads, and a wide range of assets that appeal to both beginner and advanced traders. AvaTrade and IC Markets also provide excellent services in Bhutan, with reliable customer support, competitive trading conditions, and trusted global reputations.

HFM (formerly HotForex) is the leading choice for traders in Bhutan due to its comprehensive trading offerings, user-friendly interface, and strong international reputation. With over a decade in the industry, HFM provides access to a wide range of assets, including forex pairs, commodities, indices, and cryptocurrencies. Bhutanese traders particularly appreciate the broker’s low spreads, starting from 0.0 pips, and leverage options that accommodate both conservative and aggressive strategies. One of the most notable strengths of HFM is its multilingual and responsive customer support, which ensures local traders feel supported at every stage. Additionally, the platform’s educational materials and analytical tools help novice traders improve their skills. In a country where financial literacy is growing steadily, HFM’s resources empower traders to engage with global markets confidently. The broker has built trust through strict regulatory compliance and transparency, making it a top choice in Bhutan.

AvaTrade is ranked as the second-best forex broker in Bhutan, known for its reliability, ease of use, and strong educational support. Operating since 2006, AvaTrade has established a global footprint, offering access to forex, stocks, ETFs, bonds, and cryptocurrencies. Bhutanese traders are drawn to AvaTrade’s fixed spreads and its array of trading platforms, including MT4, MT5, and AvaTradeGO. AvaTrade also shines through its commitment to regulation and investor protection, providing peace of mind to those just stepping into the world of online trading. The broker’s intuitive platform design, combined with risk management tools, helps traders in Bhutan manage volatility effectively. AvaTrade’s localized support and educational webinars make it especially appealing to younger Bhutanese investors seeking structured learning paths.

IC Markets takes the third spot for forex traders in Bhutan, especially for those who prioritize ultra-fast execution and institutional-grade liquidity. Known for its razor-thin spreads starting from 0.0 pips, IC Markets is particularly popular among more advanced and high-frequency traders. The broker provides access to over 230+ instruments, including forex, CFDs, commodities, and futures, all through robust platforms like MetaTrader 4, MetaTrader 5, and cTrader. Bhutanese traders value the transparency and real-time market data offered by IC Markets, which aligns with the country’s increasing emphasis on informed decision-making in financial activities. With over 15 years in operation and top-tier regulatory oversight, IC Markets is a solid choice for those seeking performance-driven trading conditions.

Traders’ Characteristics in Bhutan

Bhutan is experiencing a steady economic expansion, with real GDP growth reaching approximately 4.7% in 2023 and projected to accelerate to 6–7% by 2025, reflecting its strengthening recovery post-pandemic and hydropower-led diversification (tradingeconomics.com). Despite a modest-sized economy, nominal GDP stood at around USD 3.42 billion in 2023, with per capita income near USD 4,300 (en.wikipedia.org)—Bhutan boasts abundant liquidity from hydropower revenues and rising credit growth (35.8% in FY 2024–25) imf.org+15mof.gov.bt+15reuters.com+15.

Despite limited formal capital markets—with only 18 listed companies and modest market capitalization (~0.27% of GDP) on the Royal Securities Exchange of Bhutan (en.wikipedia.org+1documents1.worldbank.org+1)—local traders are increasingly exploring international trading platforms. Financial inclusion has significantly improved: mobile wallets like eTeeru and B‑Ngul and a national action plan (FINAP, 2019–23) have expanded digital finance accessibility across the country (weforum.org+8afi-global.org+8documents1.worldbank.org+8).

Although reliable data on retail forex participation is scarce, anecdotal evidence indicates that Bhutanese professionals and urban youth often invest several thousand USD annually in global assets—leveraging forex and crypto as tools for diversification and inflation hedging. This aligns with Bhutan’s dramatic rise in financial inclusion and literacy awareness programs such as NgulDumb, which targets students and young adults (weforum.org).

Notably, Bhutan has become a pioneer in green cryptocurrency mining, using surplus hydropower to mint Bitcoin and reinvesting profits into salaries and climate-smart infrastructure. As of late 2024, Bhutan held over US$1 billion in BTC, equating to about 30% of GDP (reuters.com+2en.wikipedia.org+2en.wikipedia.org+2). This innovative strategy underscores a broader trend toward digital finance and sustainable, global exposure among its financial community.

Conclusion

Bhutan’s journey into the world of forex trading reflects its broader economic transformation—grounded in sustainable growth, digital innovation, and increasing financial literacy. As global exposure expands and digital finance tools become more accessible, Bhutanese traders are well-positioned to navigate international markets with confidence. With trusted brokers like HFM, AvaTrade, and IC Markets offering secure and user-friendly platforms, investors in Bhutan have reliable options to participate in the evolving global financial landscape.

- Best Forex Broker in Jordan: Smart Traders, Steady Growth - July 31, 2025

- Best Forex Broker in Jersey – Trusted by Finance Experts - July 31, 2025

- Best Forex Broker in Japan – Trusted by Disciplined Investors - July 31, 2025