Framed by aquamarine bays and coral reefs, Antigua and Barbuda blends centuries of maritime history with an increasingly forward-looking economy. From Nelson’s Dockyard—an impeccably preserved 18th-century naval base—to colorful villages and pristine beaches, the nation’s heritage is rooted in trade, craftsmanship, and seafaring resilience. Over the last decade, that same spirit has powered a modern economic shift: tourism remains the anchor, but the country is steadily investing in infrastructure, digital services, and skills that connect its people to global opportunity.

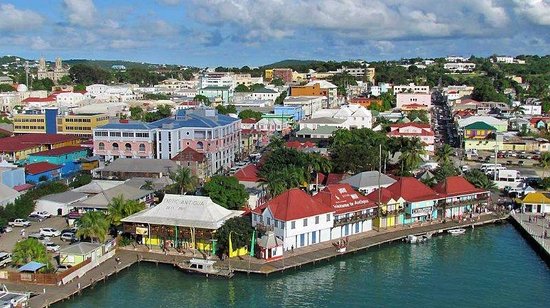

At the center of this momentum is St. John’s, the capital and commercial heart of Antigua and Barbuda. Its busy harbor welcomes cruise liners to revamped waterfront districts, while nearby business hubs and government offices coordinate investment, fiscal policy, and public-service modernization. Upgrades around the port and VC Bird International Airport have improved connectivity, supporting a steady stream of visitors and international business. The city’s growing ecosystem of professional services—banking, legal, and technology—helps channel foreign capital into local projects and new ventures.

Economically, Antigua and Barbuda has focused on prudent fiscal management, investment facilitation, and diversification. As global travel rebounded, GDP growth strengthened alongside tourism, and foreign investment inflows continued into hospitality, real estate, and infrastructure—often catalyzed by the country’s investment-friendly frameworks. Policy efforts aimed at streamlining approvals, enhancing financial oversight, and supporting small businesses have improved the operating environment, while renewable-energy projects and digitalization initiatives signal longer-term competitiveness.

Just as important is what’s happening at the grassroots level. Financial literacy is rising, boosted by community programs, online courses, and an increasingly connected youth population. More Antiguans and Barbudans are exploring international investment, forex trading, and digital entrepreneurship, using mobile platforms to learn, test strategies, and manage risk with greater confidence. Side-hustles in e-commerce, creative services, and travel-tech are becoming common stepping stones to full-time ventures, supported by professional networks and returning diaspora expertise.

This optimistic trajectory is grounded in the nation’s traditional strengths—hospitality, openness, and adaptability—now amplified by technology and a global mindset. For readers curious about emerging economies, Antigua and Barbuda offers a compelling case: a small island state leveraging heritage and human capital to build a more resilient, diversified future. From the lively streets of St. John’s to the innovative ideas taking shape online, the country’s next chapter is being written by entrepreneurs, investors, and skilled professionals who see the Caribbean not just as a destination, but as a platform for growth.

HFM is the top forex broker in Antigua and Barbuda, offering low spreads, strong global regulation, and accessible platforms ideal for both new and experienced traders. Exness and IC Markets also rank highly, providing fast execution, diverse asset options, and user-friendly tools that appeal to the country’s growing base of tech-savvy investors.

HFM – Best Overall Broker in Antigua and Barbuda

HFM, formerly HotForex, is the top choice for traders in Antigua and Barbuda due to its exceptional balance of affordability, accessibility, and advanced trading tools. With more than 14 years of global experience since its founding in 2010, HFM offers access to over 1,200 financial instruments, including forex pairs, commodities, stocks, indices, bonds, and cryptocurrencies. Traders on the islands particularly benefit from HFM’s tight spreads starting at 0.0 pips, low minimum deposit, and flexible account types. Its MetaTrader 4 and 5 platforms, mobile trading apps, and automated trading capabilities appeal to both beginners and seasoned investors. For those in Antigua and Barbuda seeking financial independence or side income, HFM provides multilingual support, educational webinars, and daily market insights that make learning and growth easier. The broker’s strong regulatory licenses and robust risk management features, including negative balance protection, create a secure and trusted environment. Thanks to its reliability and user-centered approach, HFM continues to be the preferred forex partner for the region’s emerging class of digital traders.

Exness – Best for Low-Cost Trading and Instant Withdrawals

Exness ranks second among the top forex brokers in Antigua and Barbuda, known for its ultra-competitive spreads, high transparency, and instant withdrawal system. Founded in 2008, Exness has built a reputation for offering low-cost trading conditions, including spreads from 0.1 pips, access to over 100+ currency pairs, as well as stocks, indices, energies, metals, and crypto. Local traders are drawn to Exness for its flexible leverage, unlimited under certain account types, which allows for dynamic position management based on experience and risk appetite. The broker is favored in Antigua and Barbuda by tech-savvy individuals who appreciate data-driven dashboards, fast execution, and 24/7 multilingual support. Exness is also well-regarded for its real-time financial reports and transparent trading statistics—important for investors who value accountability and control. It offers MetaTrader 4 and 5 as well as mobile-friendly platforms that support trading from anywhere. For many island-based entrepreneurs, Exness provides a dependable and efficient way to engage with global financial markets.

IC Markets – Best for Raw Spreads and Scalping

IC Markets is the third-best forex broker in Antigua and Barbuda, particularly suited to experienced traders and those who prioritize speed and precision. Established in 2007, IC Markets is a globally recognized ECN broker, offering spreads as low as 0.0 pips, with commissions starting at just $3.5 per lot. The broker provides access to a wide range of assets including forex, indices, commodities, bonds, futures, stocks, and cryptocurrencies. Many traders from Antigua and Barbuda are attracted to IC Markets’ high-speed execution, which makes it a top choice for scalping and algorithmic trading. With support for MetaTrader 4, MetaTrader 5, and cTrader, users benefit from deep liquidity and advanced trading tools. IC Markets also delivers excellent support and a clean, professional interface suitable for traders managing larger portfolios. For ambitious investors in Antigua and Barbuda seeking institutional-grade conditions from a globally trusted provider, IC Markets stands out as a strategic choice.

Traders’ Characteristics in Antigua and Barbuda

Traders in Antigua and Barbuda are generally financially aware, tech-savvy, and influenced by a strong service-sector economy that includes tourism, banking, and digital services. In 2023, the country attracted foreign direct investment equivalent to 14.79% of GDP, significantly above the world average and a sign of investor confidence in the local economic environment (TheGlobalEconomy.com). Real GDP is projected to grow by about 3.0% in 2025 according to IMF forecasts, following robust recovery years after the pandemic (IMF). With a population of just over 100,000 and an adult literacy rate of 99%, locals are structurally prepared to engage with global financial platforms (Economy.com+5IMF+5Wikipedia+5).

Although precise forex investment figures are limited, anecdotal evidence and regional trends suggest that many island residents — particularly professionals and younger entrepreneurs — tend to invest several thousand dollars annually in global markets, e-commerce, and fintech startups. The Eastern Caribbean Currency Union region’s financial literacy score stands at around 61%, indicating moderate knowledge and access to financial tools—with higher scores among those earning over $3,000 per month (ECCB Central Bank). This growing literacy, combined with dense internet and mobile connectivity, supports budding interest in forex trading and remote entrepreneurship.

Major trends include rapid uptake of digital and financial services, expansion of tourism-linked businesses into online ventures, and legislative innovation such as the Digital Assets Business Act of 2020, which supports cryptocurrency exchange licensing and blockchain-related services (IMF+15Wikipedia+15Wikipedia+15). The Eastern Caribbean Securities Exchange (ECSE) provides regional capital-market infrastructure supporting debt instruments tied to Antigua and Barbuda, further integrating its investors into broader market systems

Conclusion

Traders in Antigua and Barbuda are increasingly embracing the opportunities offered by global financial markets, supported by strong economic growth, high financial literacy, and a digitally connected population. With favorable investment laws, rising foreign capital, and a growing appetite for forex trading and entrepreneurship, the country is steadily building a vibrant and modern trading community. As infrastructure and awareness continue to grow, Antigua and Barbuda is well-positioned to thrive as a small but dynamic financial hub in the Caribbean.

- Best Forex Broker in Republic of Korea with High Trade Volume - August 1, 2025

- Best Forex Broker in North Korea – Navigating Informal Markets - August 1, 2025

- Best Forex Broker in Kiribati: Rising Interest from Island Traders - August 1, 2025